Explore the impact of the rapid surge in EV sales, sustainable battery usage, the need for high-capacity batteries, and advancements in battery chemistries and components. Examine major industry segments based on product type, application, end-user, and geography.

How is the R&D focus in businesses impacting the demand for advanced technologies? What are the innovative opportunities for stakeholders? Analyze the regional demand patterns, revenue shares of key competitors, forecasts, end-use industries like semiconductors, and more.

Identify the most prevalent developments in the FOTE landscape and the challenges that vendors face globally. Assess the key product areas that will bolster growth. Take a look at the sizing of major segments like optical time domain reflectometer, optical light source, and more.

An operation support system (OSS) is a vital component in ensuring smooth operations for connectivity service providers (CSPs). CSPs have traditionally relied on OSS solutions to manage their back-office operations of monitoring their network health and getting timely notifications in case of network faults and failures. Legacy OSS solutions can manage and monitor traditional physical network infrastructure; however, they are heavily dependent on manual interventions to fix network issues or reconfigure and redesign network elements to launch a new service. These OSS solutions also posed several other challenges, such as longer process cycles, increased security issues, and low data accuracy. The siloed architecture of a legacy OSS has often limited the capabilities of a CSP to innovate and launch new services to keep up with the growing demand from consumers and enterprises.

Schedule a dialog or email us at myfrost@frost.com to connect with an industry expert at no charge. We are taking unprecedented action to make our team available to help you cut through the media and politics to get factual one-to-one guidance for the issues and opportunities that matter most to your business.

Explore key metrics like revenue forecast, growth rate, and competitive environment

Read more Request Info

What are the alternatives to monolithic architecture and their major advantages?

Read more Request Info

Identify the test equipment dominating this space and its various industrial uses

Read more Request Info

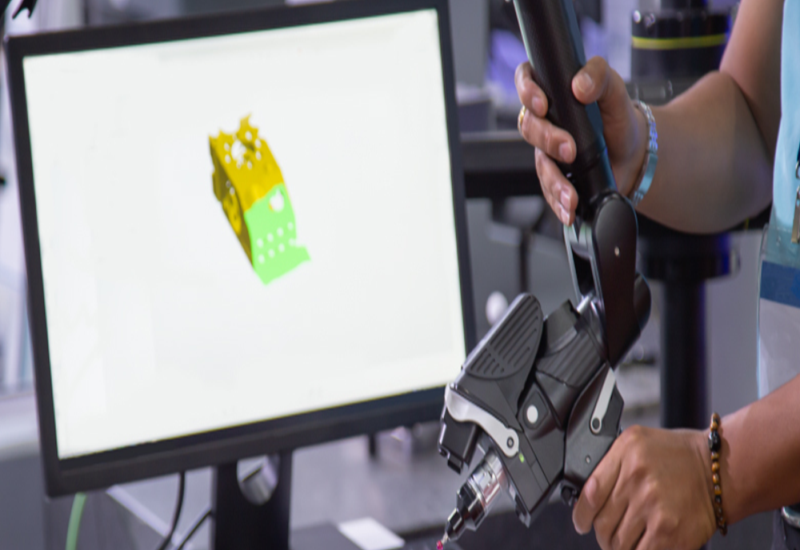

Take an in-depth look into quality control & inspection and reverse engineering

Read more Request Info

What are the key innovations in spectral imaging, smart fabrics, and more?

Read more Request Info

How are segments like coatings, wearables, pest management, and more poised for growth?

Read more Request Info

What are the transformational prospects for AI, neural processing, GeSi, and more?

Read more Request Info

What are the futuristic advancements in robotics, 3D printing, exoskeletons, and more?

Read more Request InfoThe global market for dimensional metrology software is growing as organizations across sectors expedite automation to align with their digitalization agendas. Frost & Sullivan’s recent analysis, Global Dimensional Metrology Software Growth Opportunities, finds quality inspection and reverse engineering of components across applications to be key enablers for metrology equipment and software. Therefore, the global dimensional software market is expected to reach $850.4 million by 2026 from $613.7 million in 2021, an uptick at a compound annual growth rate (CAGR) of 6.7%.

Read more

Frost & Sullivan’s analysis of the Indian mobile phone industry finds that rising internet penetration and falling smartphone prices fuel the sector’s growth. As smartphone demand wanes worldwide, the Indian mobile phone market remains underpenetrated and is growing. This presents substantial opportunities for every mobile value chain participant. The total mobile phone market (feature phones and smartphones) is forecast to generate INR 2.4 trillion in revenue by FY26 from INR 1.4 trillion in FY22, recording a 14.5% compound annual growth rate (CAGR). In terms of volume, the Indian mobile phone market consisted of 255 million units in FY22, which is likely to grow at a CAGR of 9.7% to reach 370 million units by FY26.

Read more

Based on its recent analysis of the industrial internet of things (IIoT) edge control solutions industry, Frost & Sullivan recognizes Opto 22 with the 2022 Global Enabling Technology Leadership Award. Opto 22 is a leading developer and producer of advanced products for industrial automation and IIoT solutions that integrate industrial devices into networks and computers.

Frost & Sullivan recently researched the North American manufacturing Industry 4.0 and digital transformation analytics market and, based on its findings, recognizes Northwest Analytics (NWA) with the 2022 North American Manufacturing Industry 4.0 and Digital Transformation Analytics Technology Innovation Leadership Award. The company provides global manufacturers with industrial analytics-based knowledge solutions, spanning nearly every industrial vertical.

Organizations in the industrial technologies market are readjusting their supply chains to meet growing demand, presenting lucrative opportunities for market participants. While organizations will continue to emphasize technology, companies that adopt innovative business models and adapt to changing consumer preferences are expected to flourish. Frost & Sullivan forecasts that the global industrial technologies market is estimated to hit revenues of $200 billion by 2025.

Read more