Amazon is slowly building its foothold across automotive CASE and retail avenues with its focused approach. Explore the services offered, investments and acquisitions, partnerships, its pay-as-you-go pricing model, opportunities, and much more.

How does vehicle leasing present a solution for several challenges associated with an organization's mobility needs? What are the emerging business models? What are the innovations in mobility solutions? What are the growth drivers? Find out more in this research.

What steps have been taken to improve fuel economy and emissions? What crucial role will mild hybridization play in the future? Why are mHEVs the fastest-growing electrification technology globally in the past five years? Read this research to find out.

Global energy prices increased significantly in the second half of 2021 and early 2022, buoyed by the recovery in the global economy. Russia’s invasion of Ukraine led to another dramatic spike in prices, although these have now retreated to near pre-invasion levels, as key OPEC producers signaled they will increase the global supply. But what could Russia’s invasion of Ukraine mean for global energy markets in the medium to long terms? What are the possible growth opportunities for companies servicing the sector?

Schedule a dialog or email us at myfrost@frost.com to connect with an industry expert at no charge. We are taking unprecedented action to make our team available to help you cut through the media and politics to get factual one-to-one guidance for the issues and opportunities that matter most to your business.

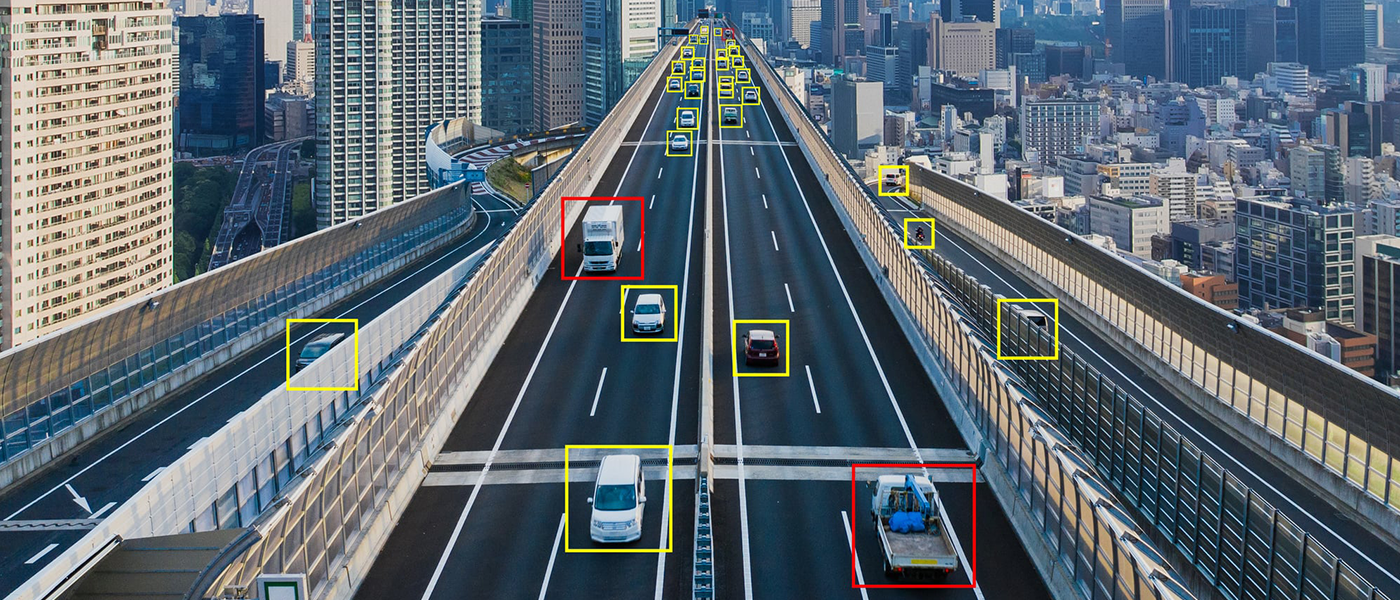

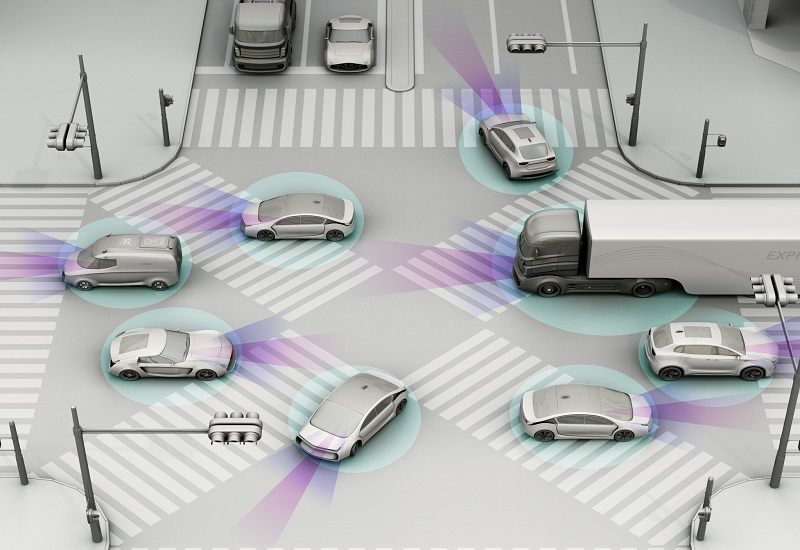

What benefits are achieved with 4D imaging radar technology?

Examine why AVs should have full visibility of their environment

Read more Request Info

Which business models propel innovation in mobility solutions?

Read more Request Info

Examine the innovations that will transform this segment

Read more Request Info

What are the macroeconomic factors impacting the region?

Read more Request Info

Analyze the technology, sales, parc, infrastructure, and regulations

Read more Request Info

Explore how OEMs can increase their revenue from connected services

Read more Request Info

What will be the implication of remote working in this segment?

Read more Request InfoAs the world deals with one challenge after another – from the coronavirus pandemic to the ongoing conflict in Europe – the automotive industry too is working its way through several challenges driven by changing customer and business (B2C and B2B) demands. AWS for Automotive showcases how evolving customer demands can be successfully fulfilled not just by being a business partner but by being a partner in co-creating a seamless mobility ecosystem for development and deployment.

Read More

In more buzz-worthy developments emerging from the global electric vehicle (EV) market, Japanese titans Sony Corp and Honda Motor Co Ltd have declared that they will be partnering to fast-track their EV ambitions. Their recently announced joint venture will design, develop and deliver battery-powered EVs, with the first model set for commercial roll out in 2025.

Read More

A recently announced partnership will see the US-based Luminar Technology’s Iris laser LiDARs integrated into Mercedes-Benz’s autonomous vehicles. Under the terms of the agreement and to constantly improve its autonomous driving technology, Luminar will have access to data generated by these vehicles. Mercedes-Benz has, moreover, picked up a 1% stake in Luminar. It is interesting to note that just in 2021, Mercedes equipped its vehicles with Valeo’s scala LiDAR to launch its level 3 autonomous feature called Drive Pilot.

Read More

2021 was a challenging year for the automotive industry due to changing consumer attitudes towards mobility and chip shortage, which led to reduced production. There is an accelerated and irreversible change in mobility patterns of the customers that automotive players are grappling with. Widespread acceptance of hybrid working impacts mobility patterns, and the pervasive nature of e-commerce is digitizing consumer journeys faster than ever.

Automotive original equipment manufacturers (OEMs) are expected to replace powertrain suspension and steering systems with electric corner modules (ECMs) as the demand for purpose-built vehicles increases. This will lower initial investments and reduce the time to market. As ECMs enable greater flexibility through increasing modularity and reusability, OEMs can efficiently use available space and reduce the lead time for new models.

Frost & Sullivan’s recent analysis of the global autonomous vehicles (AVs) regulatory landscape finds that increasing automated safety requirements necessitate a robust regulatory framework for AVs. Initiatives by advanced nations such as Germany, which regulated consumer use of Level 3 (L3) low-speed autonomous lane-keeping systems (ALKS); Japan, which regulated consumer deployment of L3 vehicles; and regulatory bodies such as the United Nations Economic Commission for Europe (UNECE) and National Highway Traffic Safety Administration (NHTSA), have developed regulatory guidelines for assessment, testing, and deployment of AVs.

Read more