With economic distress caused by the pandemic, this industry is expected to recover and grow due to proactive marketing schemes, product launches, and the entry of new participants. Analyze the disruptions, demand for eco-car models, and charging infrastructure.

This mature aftermarket is a high-volume one, with well-established participants who have strong relationships across all distribution channels. From this research, get insights on the growth opportunities, big predictions, industry forecasts, go-to-market strategies, and competitors.

Which are the fastest-growing OEMs, and which models have disrupted sales trends or exposed demand in the industry? What are the market shares for PHEVs, BEVs, FHEVs, and MHEVs, and how have they grown since 2010? What are the growth opportunities? Find out in this research.

After a year and a half in the COVID era, most business travel has halted or trickled down by over 90% and in some countries, 100%, according to many international organizations. Business travel has changed in many aspects and will not return to pre-COVID levels anytime soon. Many have predicted a return somewhat in Q4 2021 or by Q3 2022 at the latest. I doubt this.

Travel needs to be categorized in two ways

1. Domestic Travel - air travel, train car, etc. In Japan, for example, most travel has stopped, but there are some cases for essential travel like fixing equipment or face-to-face meetings. In the US, business travel is coming back but to a lesser degree than 2019 numbers.

2. International Travel - air predominantly. Most travel has been halted for a number of reasons, including PCR test requirements and quarantines of one week to 14 days - some even as high as three weeks. Some countries are totally locked down. Due to this, I expect most international business travel to remain blocked until the second half of 2022.

Schedule a dialog or email us at myfrost@frost.com to connect with an industry expert at no charge. We are taking unprecedented action to make our team available to help you cut through the media and politics to get factual one-to-one guidance for the issues and opportunities that matter most to your business.

Disruptive Innovations Driving Growth in Car Retail & Aftersales

Growth Prospects Transforming NA Logistics and Transportation

Read more Request Info

Emerging Growth Opportunities in China's Electric Two-wheeler Industry

Read more Request Info

Potential Growth Opportunities in Germany Light Vehicle Leasing

Read more Request Info

Novel Growth Avenues in Global L2+ Advanced Driver Assistance Systems

Read more Request Info

Global Electric Vehicles Industry: Growth Opportunities Revealed

Read more Request Info

Novel Growth Avenues in the GCC Light Vehicle Aftermarket

Read more Request InfoUntil a year ago, intensifying urbanization was the norm, with cities confronting challenges related to congestion, pollution, and overstretched mobility networks. In the UK, estimates indicated that people were spending more than 221 days of their lives commuting; in the US, it was more than 400 days.

Read More

COVID-19 and its aftermath will test the business sustainability and resilience of shared mobility companies. With the change in fundamental market dynamics as a result of the pandemic, stakeholders are already in the process of designing new strategies and roadmaps for growth.

Read More

Automated driving (AD) is one of the main catalysts of this shift and is creating massive opportunities and challenges for automakers. Intensifying safety and certification requirements and spiraling complexity are highlighting the key role of simulation in AD development.

Read More

Frost & Sullivan’s recent analysis finds that the growing adoption of electric transit buses, driven by pro-green government policies, has enabled global sourcing and supply chain for alternate powertrain buses. The total electric bus market, which comprises hybrid electric vehicles (HEVs), plug-in hybrid electric vehicles (PHEVs), battery electric vehicles (BEVs), and fuel cell electric vehicles (FCEVs), is projected to exceed 211,000 units by 2030.

Frost & Sullivan’s recent analysis of the global autonomous driving industry finds that original equipment manufacturers (OEMs) and value chain partners are streamlining their strategies, capital investments, and product roadmap to develop and deploy region- and segment-specific partial and highly automated vehicles. By 2025, one in five cars in developed regions will offer one or more Level 2 (L2) features due to stiff competition.

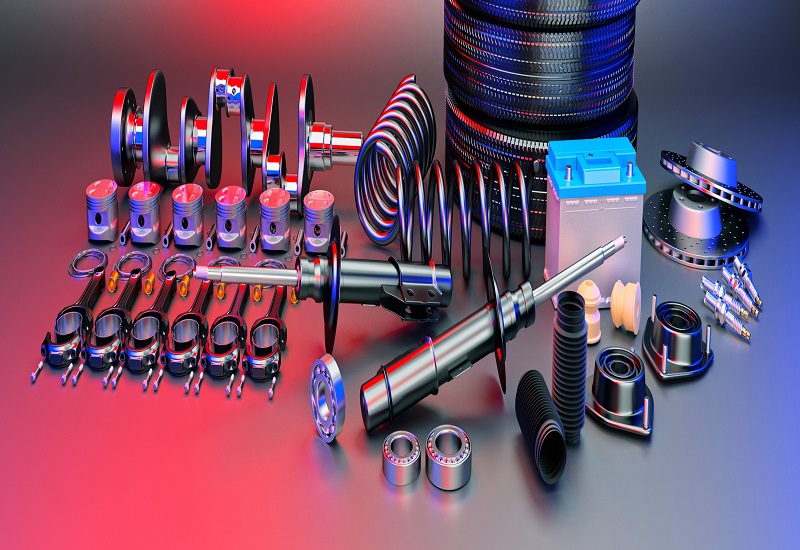

The rapid adoption of digitization to mitigate the adverse impact of COVID-19 on the global automotive aftermarket has fueled investments in this space. Although the aftermarket demand for replacement parts and accessories declined 8.8% in 2020, online sales are rising as the global market recovers. They are expected to reach $478.8 billion by 2025 at a 5.7% compound annual growth rate (CAGR) from $362.2 billion in 2020.

Read more