This report provides a comprehensive analysis of the physical aspect of security and uncovers the top predictions for global security leaders, businesses, and governments. Explore the covered segments - CNI, public safety, and border security; along with the tech landscape and growth opportunities.

This sector is undergoing significant changes with increased budgets. This report analyzes the three military segments covering the current and future equipment plans of the armed force. It also examines Indonesia’s position in a changing region and the country's goal of securing a minimum essential force.

The aviation industry is in the midst of a crisis and the airport segment is one of its hardest hit participants. With COVID and travel restrictions decreasing passenger volumes, examine how airports must identify their strategic advantages over competitors to combat this.

1. Time for change

2021 will (fingers crossed) go down in history as the year the world started to take climate change seriously. In April, the UK and Chinese governments announced ambitious goals of achieving carbon zero by 2050 and 2060 respectively. America plans to achieve a 50-52% reduction from 2005 levels in economy-wide net greenhouse gas pollution by 2030.

In the corporate world, high-tech businesses such as Microsoft, Apple and Novo Nordisk and service companies such as EY, Sky and KPMG have set their sights on achieving carbon zero by 2030. The more energy intensive industries including manufacturers (Cemex, Holcim and Tetrapak), oil and gas firms (BP, Shell and Total) and airline companies (BA, American Airlines and Japan Airlines) plan to reach this target by 2050.

Schedule a consultation with an industry expert at no charge by contacting us at myfrost@frost.com. We are taking unprecedented action to make our team available to help you cut through the media and politics to get factual one-to-one guidance for the issues and opportunities that matter most to your business.

New Digitized Solutions are Powering the Growth of Airport Security

Read more Request Info

Disruptive Technologies and Growth Hubs in Airport Security CONOPS

Read more Request Info

How is AI Driving the Growth of Global Geospatial Value-added Services?

Read more Request Info

Digitalization and Security Convergence Drive Growth in the Security Industry

Read more Request Info

Naval Command and Control Sector Evolves with Geopolitical Instability

Read more Request Info

Growth Avenues for the Airport Passenger Flow Industry

Read more Request Info

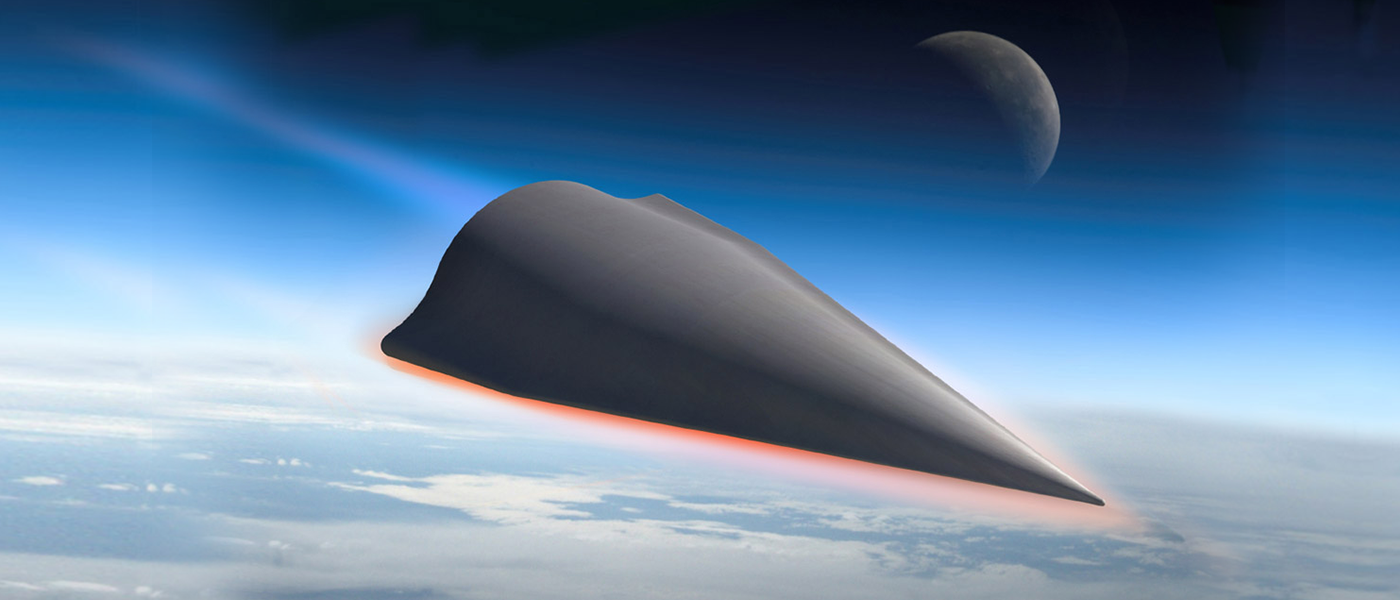

CONOPS Powering the Growth of the Global Airborne Radars Sector

Read more Request InfoWhile the question of when premium traffic will make a comeback is something that is in the mind of every executive in airline boardrooms across the world, a more immediate question is what will it take for this all-important segment to take off again. Similar to leisure traffic, the underlying base requirements will be the same: reopening of borders, easing of travel restrictions, and preservation of air travel corridors.

Read more

The 2021 Merger & Acquisition series kick-started with digital imaging and electronic sensor manufacturer Teledyne Technologies Incorporated and thermal imaging and UAS maker FLIR Systems, Inc. entering a definitive agreement in which Teledyne would acquire FLIR in a whopping $8.0 billion deal.

Read more

Frost & Sullivan’s recent analysis finds that while corporate and consumer businesses remain popular marks for cyberattacks, critical infrastructure facilities have become increasingly viable threat targets. They are highly vulnerable to major operational disruptions and cyber incidents that can lead to real-world peril.

Frost & Sullivan’s recent analysis, Transformative Mega Trends in the United States through 2030, examines the complex intersections of social, education, work, political, economic, and urbanization trends set to converge in the next decade. Social trends will be the biggest drivers of disruption, including the evolution of millennials, the rise of Gen Z, growth of the elderly demographic, expanding Hispanic and Asian populations, and income divides.

Frost & Sullivan’s recent analysis, US DoD Electronic Warfare, 2020–2025, finds that in 2021 the integration of commercial information technology (IT) products with legacy electronic warfare (EW) technologies will accelerate. EW spending through 2025 is expected to remain stable, and the US Department of Defense (DoD) electronic warfare market is estimated to reach $3.6 billion by 2025 from $3.17 billion in 2021.

Read more