The Rise of Renewables Leads the Way to Decarbonization

Senior Vice President and Practice Leader for Energy, Industrial & Sustainability

What’s decarbonization, and why is it important? Decarbonization refers to the steady reduction of carbon dioxide (CO2) emissions and, eventually, its elimination. The deployment of decarbonization technology aids emission-intensive industries in minimizing carbon emissions and meeting net-zero emissions protocols in the long term. To cut down carbon emissions and combat climate change, governments across the globe are counting on the five pillars of decarbonization: the rise of renewables, hydrogen economy, direct electrification and renewable heat, carbon capture utilization and storage (CCUS), and energy efficiency. Their implementation can be a potential game-changer to enable stakeholders to achieve carbon neutrality globally.

Renewable Energy Investments—Where’s the Money Going?

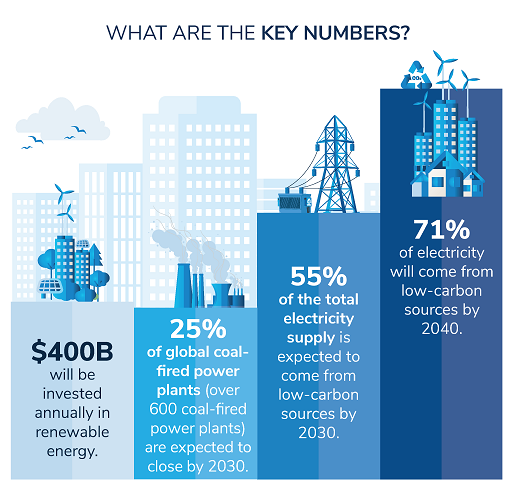

Annual investments in renewable energy sources should average $400 billion each year over the next decade, peaking at $500 billion in 2030. Their sources include wind, solar, geothermal, and sustainable bioenergy, of which Frost & Sullivan expects solar photovoltaic (PV) and wind to dominate investments.

Renewables provide attractive financial benefits for investors while helping the world’s citizens mitigate and adapt to climate change and deliver tangible solutions to help meet the United Nation’s Sustainable Development Goals (SDGs).

The rise in renewables is also key to achieving decarbonization (reducing or removing carbon dioxide emissions in the atmosphere), with low-carbon electricity expected to account for 71% of the total electricity supply by 2040.

What’s Driving this Upturn?

The transition toward a decarbonized electricity system is driven by a combination of factors, including the rise in renewables. But what’s driving this rise? In part, this transition to renewable energy sources is a global response to climate change that is already significantly affecting many countries.

Supportive government policies and incentives also fuel investments in energy infrastructure and technologies to ensure resilience and meet SDG targets. In addition, organizations’ environmental commitments are driving momentum toward global decarbonization. As the geopolitical context brings energy to the table, efforts rise. This is shown in how nearly 25% of the EU’s electricity came from wind and solar in the six-month period from March 2022, helping the grouping to save billions of Euros since the Russian invasion of Ukraine, when gas prices spiked.

IEA has predicted that global energy investment in 2022 is likely to reach US$2.4 trillion, representing an increase of 8% over 2021. While most of the increase is attributed to clean and renewable energy investments, this still falls significantly short of the investment required to meet the targets of the Paris agreement. In a year shadowed by significant geopolitical and economic events, including war in Ukraine and record high inflations, all eyes will be on the financial commitments that developed countries are going to make at COP27 in Egypt to help finance the clean energy transition of the developing world.

As energy demand increases and coal-fired power plants are phased out (over 25% will be phased out globally within the next decade), this could provide a supportive market for growth in renewables. In addition, renewables could become a viable and affordable alternative to fossil fuels as the unsubsidized cost of renewable projects and technologies decreases.

Key Growth Opportunities: Investing in Renewable Energy

Renewable energy projects are sought-after by investors because of their attractive and consistent return on investment (ROI). As demand for renewable energy sources increases, this presents a range of key growth opportunities for businesses, such as:

- Original equipment manufacturers (OEMs) can supply renewable energy equipment, and project managers can provide services for abundant renewables projects in almost every country worldwide.

- Companies can provide advanced servicing solutions that can further reduce operating expenses (OPEX costs) and drive ROI for renewables.

- Businesses can provide an array of demand optimization solutions in response to the increasing demand for energy supply.

- The business sector can create additional revenue streams by converting energy consumers into prosumers (both producers and consumers of energy) and getting them to use their renewable generation assets to feed energy into the grid.

Final Thoughts

The growth of sustainable forms of energy is expected to expand exponentially over the coming decade, helping the world transition away from using fossil fuels to meet climate, decarbonization, and SDG goals.

Fueled by widespread government support and in response to climate change, the rise in renewables is also driven by rising global energy demand and competitive pricing for renewables.

Some of the most significant growth opportunities this provides for businesses include the provision of equipment and services for renewables projects around the world, advanced servicing solutions that reduce OPEX costs, and new revenue streams created by transforming consumers into prosumers.

Did we miss anything? If you want to learn more about our sustainability actions, check this out.

Learn more about sustainability, its inherent growth opportunities, and how Frost & Sullivan can partner with your company to build and implement an effective, powerful sustainability agenda. Contact us today.

REQUEST INFO